Inflation is on the rise, and it’s hitting Canadian small businesses hard. When costs increase across the board, from raw materials to everyday operating expenses, small business owners are faced with tough decisions about how to keep their businesses afloat. But what are the real costs of inflation, and how does it affect businesses in a tangible way?

1. Rising Operating Expenses

One of the most immediate and obvious impacts of inflation is the rise in the cost of goods and services. Whether it’s the price of raw materials, rent, or utilities, business owners are seeing their expenses climb. In fact, according to recent data from Statistics Canada, the Consumer Price Index (CPI) jumped by 3.3% year-over-year as of July 2023, with food, transportation, and energy prices leading the charge.

A recent survey revealed that 89% of Canadian small business owners rank inflation as their top concern, even more than rising interest rates or fuel prices. For small businesses, this usually means having to make tough decisions about raising prices to protect their profit margins or absorbing higher costs in an already tight budget.

The issue, however, isn’t just about higher costs. When businesses raise prices, they risk losing customers who are also feeling the pinch of inflation. Striking a balance between maintaining profitability and keeping prices reasonable becomes a delicate juggling act.

2. Wage Pressures

Inflation doesn’t only affect business expenses; it also puts pressure on wages. As the cost of living rises, employees expect higher wages to keep pace. According to a survey conducted by the Canadian Federation of Independent Business (CFIB), 62% of small business owners are feeling the pressure to raise wages to keep up with inflation.

For many small businesses, this presents a real challenge. Increasing wages can help retain talent, but it also adds to the growing list of expenses. In some cases, businesses are forced to reduce headcount to keep payroll manageable, which can further strain operations and employee morale.

3. Increased Borrowing Costs

Inflation often leads to higher interest rates as central banks attempt to stabilize the economy. With the Bank of Canada raising interest rates to 5% in September 2023, borrowing has become significantly more expensive for small businesses.

Many small businesses rely on loans or lines of credit to cover their expenses or invest in growth. Now, with rising interest rates, the cost of borrowing is significantly higher. This can deter business owners from pursuing expansion plans or even maintaining existing operations, as paying off debt becomes more expensive.

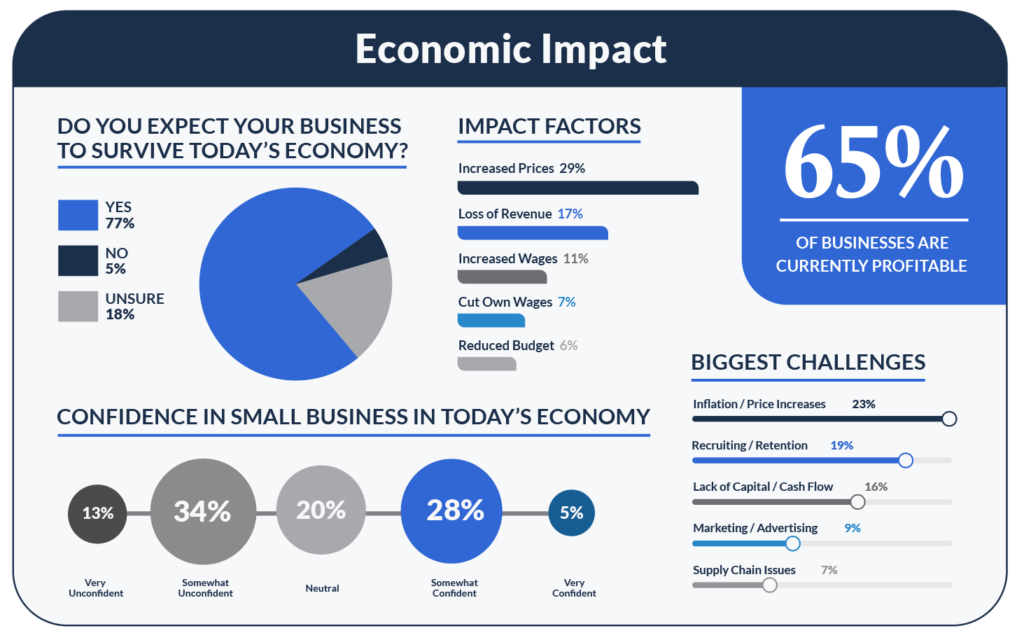

A survey showed that 65% of businesses report being currently profitable, but inflation and price increases remain one of their biggest challenges. Small businesses are feeling the squeeze from all sides.

4. Falling Consumer Demand

As inflation eats away at consumers’ disposable income, small businesses that rely on discretionary spending are feeling the pinch. When everyday essentials like groceries, gas, and housing become more expensive, consumers are less likely to spend money on non-essential items and services. According to a 2023 report from Deloitte, 53% of Canadians have adjusted their spending habits due to rising prices.

For small businesses, this can translate into lower sales and reduced revenue. Maintaining customer loyalty and encouraging purchases becomes even more important during these times. Strategies like offering promotions, bundling services, or loyalty programs can help businesses stay afloat when customers are tightening their belts.

5. Cash Flow Challenges

Inflation has a significant impact on cash flow. When prices rise faster than revenue, small businesses often find themselves in a cash flow crunch. According to a report by the CFIB, 40% of Canadian small businesses are struggling with cash flow management. Without careful planning and budgeting, many businesses find it difficult to meet their financial obligations.

For some small businesses, this can lead to mounting debts or even insolvency. It’s more important than ever for business owners to keep a close eye on their cash flow, cut unnecessary expenses, and find ways to operate more efficiently.

6. The Long-Term Cost of Doing Nothing

Inflation isn’t something businesses can afford to ignore. Without a proactive approach, the rising cost of goods, wages, and borrowing can eat away at profits and put even the most stable businesses at risk. While the challenges are significant, small businesses that adapt can still thrive.

By taking steps like carefully managing expenses, keeping a close eye on cash flow, and finding ways to retain key employees, small businesses can mitigate the impact of inflation and position themselves for long-term success.

Key Takeaways for Small Businesses Facing Inflation:

- Stay on Top of Your Expenses: Monitor rising costs closely and look for ways to streamline operations.

- Adjust Prices Carefully: Raising prices may be necessary, but be sure to communicate the value behind any increase.

- Focus on Employee Retention: Offering creative compensation options, such as flexible working hours or benefits, may help retain staff without drastically increasing payroll.

- Plan for Cash Flow Issues: Work with financial advisors to ensure that your cash flow remains strong even as costs rise.

References:

- Statistics Canada. “Consumer Price Index, July 2023.” Accessed September 2023.

- Canadian Federation of Independent Business (CFIB). “Inflation’s Impact on Small Business Wages.” Survey Report, 2023.

- Bank of Canada. “Interest Rate Announcement – September 2023.”

- Deloitte Canada. “Inflation and Consumer Spending in Canada.” Consumer Trends Report, 2023.

- Canadian Federation of Independent Business (CFIB). “Small Business Debt and Cash Flow Issues.” CFIB Report, 2023.

Ctrl C To Copy

June 1, 2025 2:38 pmThis design is incredible! You definitely know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost...HaHa!) Wonderful job. I really loved what you had to say, and more than that, how you presented it. Too cool! my website - ctrl c to copy

Youtube Downloader

July 4, 2025 2:38 pmyou are really a excellent webmaster. The website loading speed is amazing. It kind of feels that you are doing any distinctive trick. Also, The contents are masterpiece. you have done a excellent process on this matter!